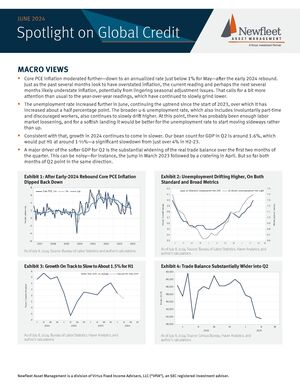

Core PCE inflation moderated further—down to an annualized rate just below 1% for May—after the early 2024 rebound. Just as the past several months look to have overstated inflation, the current reading and perhaps the next several months likely understate inflation, potentially from lingering seasonal adjustment issues. That calls for a bit more attention than usual to the year-over-year readings, which have continued to slowly grind lower.

This commentary is the opinion of Newfleet Asset Management. This material has been prepared using sources of information generally believed to be reliable; however, its accuracy is not guaranteed. Opinions represented are subject to change and should not be considered investment advice or an offer of securities.

Past performance is no guarantee of future results.

All investments carry a certain degree of risk, including possible loss of principal.

3707721